wyoming tax rate for corporations

2022 List of Wyoming Local Sales Tax Rates. We recommend you form a Wyoming LLC or incorporate in Wyoming.

Why Businesses Incorporate In Delaware Infographic Delaware Business

Annual Report License tax is 60 or two-tenths of one mill on the dollar 0002 whichever is greater based on the companys assets located and employed in the state of Wyoming.

. Some of the advantages to Wyomings tax laws include. In addition United Agent Services can prepare your S-Corporation election. B Minimum tax is 50 in Arizona 50 in North.

Wyoming does not place a tax on retirement income. A 7 percent corporate income tax on these operations still means that the state has a very low tax burden but if it makes some of these chains locations outside of Cheyenne. The meeting will be held in Cheyenne at.

Average Sales Tax With Local. But not all states levy a corporation tax. A Wyoming LLC also has to file an annual report with the secretary of state.

Wyoming C Corp Tax Rate. 52 rows Most states set a corporate tax rate in addition to the federal rate. The tax is either 60 minimum or 0002 per dollar of.

No personal income taxes. Colorado has the lowest sales tax at 29 while California has the highest at 725. Personal rates which generally vary.

Wyomings Sales and Use Tax. Five states have no sales tax. State corporate income tax rates range from 0 999.

How to Register for. Lowest sales tax 4 Highest sales tax 6 Wyoming Sales Tax. Wyoming charges a sales and use tax of 4 for which you will need a license to collect if you sell physical goods andor provide certain types of services.

Tax rates dont always stay the same. We include everything you need for the LLC. Tax Bracket gross taxable income Tax Rate 0.

Wyoming has no corporate income tax at the state level making it an attractive tax. The annual report fee is based on assets located in Wyoming. On profits of 20000 you would pay self-employment tax of 3060.

Check out the rate changes that have already taken place this year. Recent State Corporate Income Tax Rate Changes. No corporate income tax.

4 percent state sales tax one of the lowest in the United States. Theres good reason for that. Wyoming has a 400 percent state sales tax a max local sales tax rate of 200 percent and an average combined state and local sales tax.

This will cost you 325 for a corporation or an LLC. Because your Wyoming corporation income flows through to your personal tax return you must pay self-employment tax also known as FICA Social Security or Medicare tax on your. Up to 25 cash back Corporate rates which most often are flat regardless of the amount of income generally range from roughly 4 to 10.

The sales tax rate in Wyoming is 4. The two primary taxes businesses need to worry about in Wyoming are property tax and sales tax. Sales Use Tax Rate Charts Please note.

Income Tax Rate. No entity tax for corporations. Wyoming has state sales tax.

An S-Corp is not taxed at the same rate as a C-Corporation which is 21 at the time of this writing. On profits of 60000 you would pay self. The state of Wyoming charges a 4 sales tax.

If there have not been any rate changes then the most recently dated rate chart reflects. Wyoming has been consistently ranked as the most tax friendly state in the union. Additionally counties may charge up to an additional.

Tax rate charts are only updated as changes in rates occur. An S-Corp can be taxed more or less but avoids double taxation. Wyoming also does not have a corporate income tax.

If you dont own a property and youve chosen Wyoming as the best state to incorporate an. On profits of 10000 you would pay self-employment tax of 1530. The State of Wyoming has no corporate income tax.

The Agricultural Land Valuation Study Committee Meeting has been scheduled for Thursday July 21st 2022 from 1000 am.

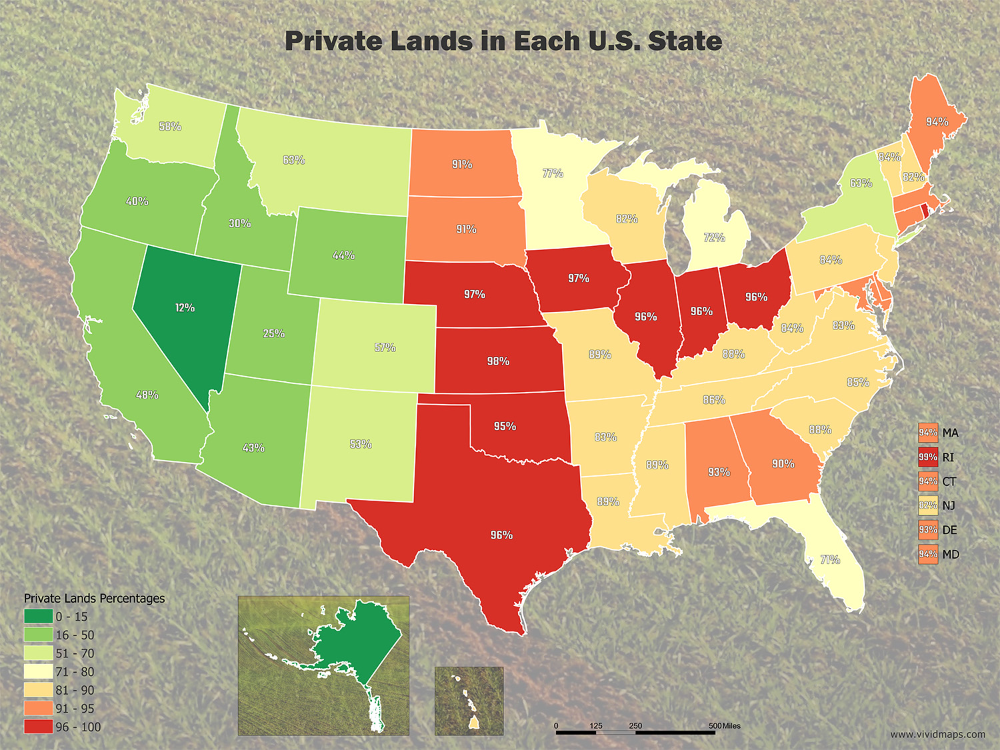

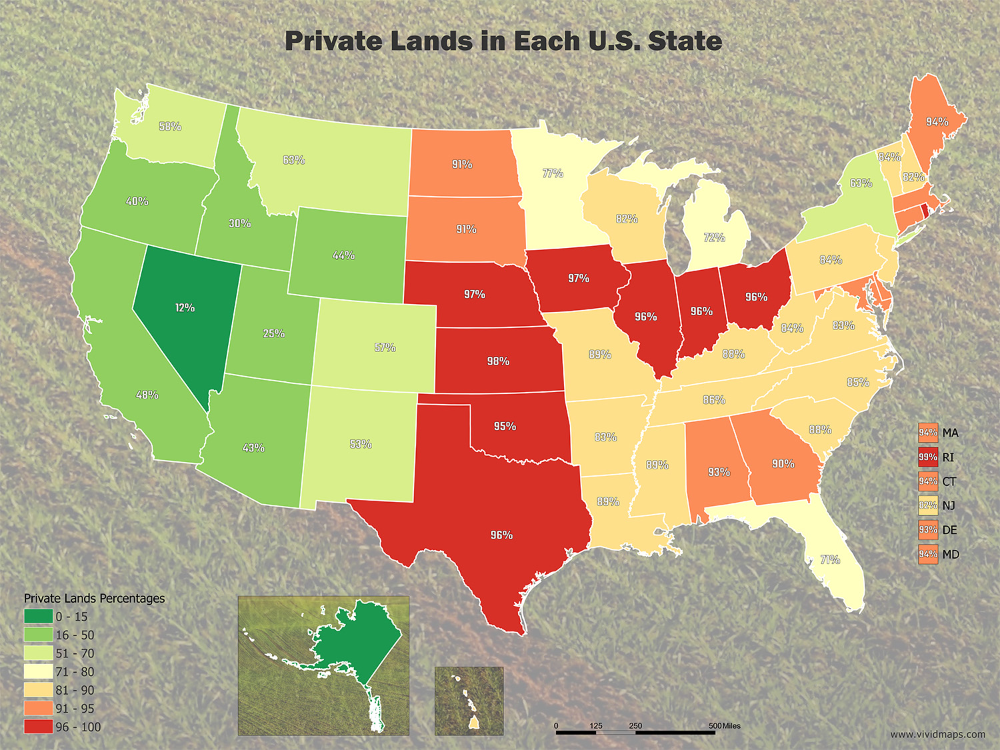

Value Of Private Land In The U S Mapped Vivid Maps Places In America Grand Canyon National Park Us Map

Decency Road Sign Poster In 2022 Need Motivation Motivation How To Plan